NEWS & BLOG

Views: 199 Author: Site Editor Publish Time: 2022-07-26 Origin: Site

International Commercial Terms, referred to as Incoterms. It is not a law, but it is binding on buyers and sellers after confirmation. The International Chamber of Commerce (ICC) first introduced Incoterms (International Trade Terms) in 1936 to provide guidance to buyers and sellers in the formulation and performance of contracts of carriage of goods. The role of Incoterms are simplify transaction negotiation, clarify the responsibilities and obligations of buyers and sellers, divide the risks and payments that buyers and sellers need to take, facilitate the calculation of prices and costs, and help resolve disputes. It is changed every ten years in order to facilitate the operational process of international trade. From a trade finance perspective, understanding the point of risk transfer also helps in determining the amount of invoice financing to be used. In order to keep up with the ever-changing global trade environment, the ICC timely launch of the latest version of Incoterms 2020, and January 1, 2020 officially came into force this is also the first update since 2010.

Want to know how the rights and obligations of buyers and sellers have changed and Incoterms 2020 types? Learn now about.

In this What are Incoterms 2020 - International Trade Terms Guides by 2 parts

Incoterms 2020 Highlights Changes

The most important change is the FCA (Fulfillment of Cargo to Carrier), where the buyer can now instruct its carrier to note loaded on the Bill of Lading and then issue and deliver a bill of lading to the seller to satisfy the terms of the letter of credit. Prior to this, although the delivery cost of FCA is lower than FOB and more suitable for transporting containerized cargo, many exporters prefer to use FOB (Free on Board at the port of shipment) in order to meet the payment terms of the letter of credit.

In addition, Incoterms2020 also introduced DPU (Delivery at Unloading) instead of DAT (Delivery at Transport Terminal). This change is because the term "terminal" previously caused confusion, while DPU covers all delivery situations.

CIP (Freight and Insurance Premium) has been amended so that the seller must purchase a higher level of insurance more suitable for manufactured goods at 110% of the invoice value, in accordance with the Association's Cargo Insurance Clause A. For CIF (Cost, Insurance and Freight), which is used for the transportation of goods, the Association Cargo Insurance Clause C provides for insurance requirements, which remain unchanged compared to the previous edition of the General Conditions.

In addition, FCA (Fulfillment to Carrier), DAP (Delivery at Location), DPU (Delivery at Place of Unloading) and DDP (Delivery Duty Paid) now allow the buyer and seller to make their own shipping arrangements without the need for third party arrangements.

It has also become clearer how to allocate the bearer costs between the buyer and the seller to avoid disputes. In Incoterms 2010, when carriers added surcharges and changed their pricing methods, costs sometimes became a big issue and the seller would have to bear additional transportation terminal handling costs.

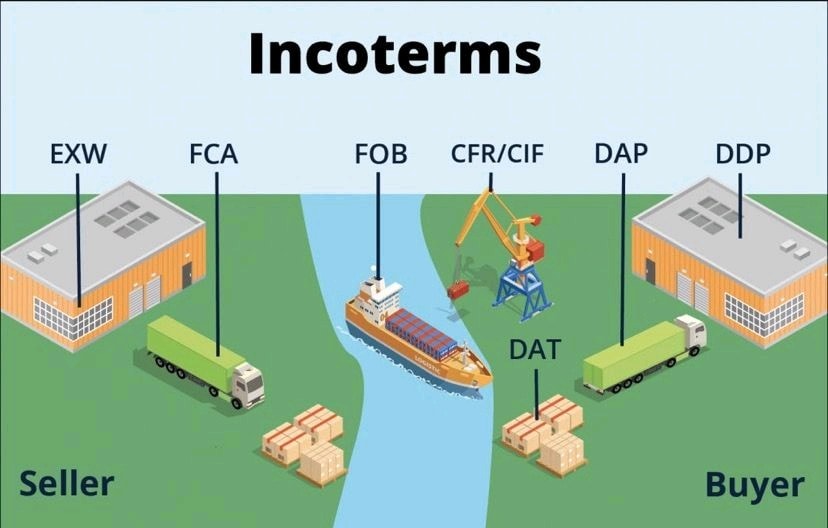

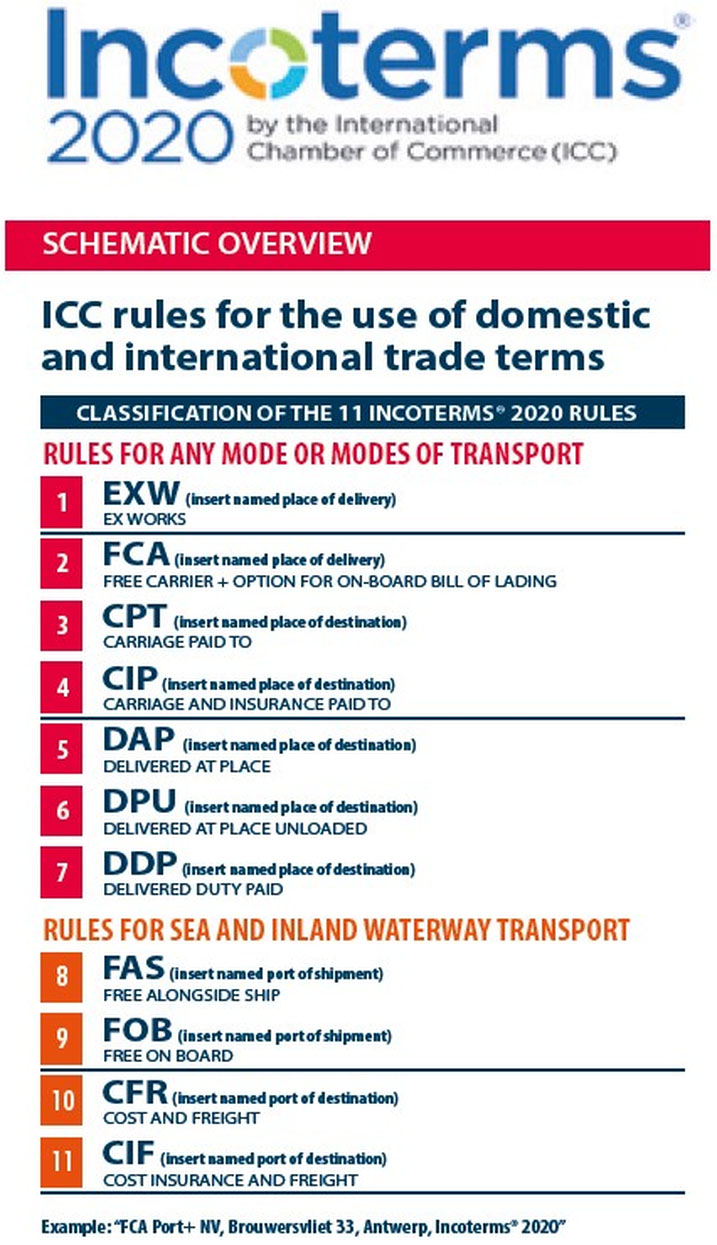

Incoterms defines the responsibilities of the buyer and seller at different points in the transport, the updated eleven trade terms can be divided into two separate groups, some trade terms are more applicable to certain modes of transport.

Classification of the 11 Incoterms 2020 Rules

Documents for Buyer's / Seller's Account

EXW - Ex Works Factory Delivery

The EXW terminology makes the seller responsible for delivery at his own premises or other designated place (factory, office or warehouse). Ownership of the goods then passes to the buyer, who assumes all costs and risks from the time the goods are received.

EXW is most advantageous for the seller, who is not responsible for subsequent transportation costs after the goods leave the place of delivery and is not required to clear the goods for export. If the goods need to be exported, the use of this trade term may cause inconvenience for the buyer.

FCA - Free Carrier

FCA makes the seller responsible for transporting the goods to the buyer's designated place, loading the goods onto the buyer's means of transportation, and arranging transportation procedures including export customs clearance and security requirements. The risk passes to the buyer when the goods are loaded on the buyer's carrier.

The buyer is responsible for payment of transportation charges, bill of lading, insurance, unloading charges and local freight all the way to the final destination. Any damage to the goods while on board the vessel is borne by the buyer.

FCA is the most changed trade term in Incoterms 2020. Prior to the amendment, third-party responsibility for transportation resulted in the seller not being able to obtain a bill of lading with the notation "shipped" because the seller did not present the goods directly to the international carrier. Without a bill of lading, the trading bank would not authorize payment to the seller. Under the latest version of the FCA, this problem has been solved by allowing the buyer and seller to stipulate in the sales contract that the buyer shall instruct the carrier to issue a bill of lading to the seller marked "shipped".

CPT - Carriage Paid To (...... named destination)

The CPT goes a step further from the FCA by stipulating that the seller shall bear the cost of transporting the goods to the destination specified by the buyer. The seller will clear the goods for export and deliver them to the carrier or other person arranged by the buyer at the named place of shipment, at which point the risk passes to the buyer. The seller bears the transportation costs associated with delivering the goods to the named destination, but is not responsible for purchasing insurance.

Under CPT, the seller is not responsible for purchasing insurance. If the buyer requires the seller to purchase insurance, then the trade term CIP should be considered.

CIP - Carriage and Insurance Paid to (...... named destination)

CIP is largely similar to CPT, with the difference that the seller must pay for the insurance of the shipment and the cost of the shipment itself.

DPU - Delivered at Place Unloaded

This trade term was named Delivery at Terminal of Transport (DAT) in the previous version and was updated and renamed DPU because the buyer or seller may wish to deliver at a location other than the terminal of transport. The term is commonly used for consolidated containers with multiple consignees. It is also the only trade term that requires the seller to unload the goods.

The seller will pay all transportation costs (export charges, transportation fees, unloading from the carrier at the destination port and destination port charges) and assume all risk until arrival at the destination port or terminal. Buyer assumes all costs and risks after unloading, including import duties, taxes, customs clearance and local transportation to the final named destination. If the seller is unable to arrange unloading, then the trade term DAP should be considered.

DAP - Delivered At Place

The seller delivers the goods to the named destination, but is not responsible for unloading. The seller's responsibility includes packing, export customs clearance, transportation costs and any charges at the agreed port of destination.

The DAP provides that the buyer bears all charges, duties and taxes associated with unloading the goods and is responsible for import clearance of the goods in the country of the named destination. Risk passes to the buyer at the final named destination.

DDP - Delivered Duty Paid

DDP provides that the seller assumes all risks and expenses in delivering the goods to the named destination for unloading and import clearance.

The seller is responsible for customs clearance of the goods in the buyer's designated country, including payment of duties and taxes, obtaining approvals and registration as required by the authorities of that country. However, the seller is not responsible for unloading the goods.

If this trade term is used, the seller is responsible for the most and the buyer for the least. No risk or liability is transferred to the buyer until the goods are delivered to the designated final destination.

Unless the seller is very knowledgeable about the rules and regulations of the buyer's country, DDP can be very risky in terms of both delays and unforeseen additional costs and this trade term should be used with caution.

When the goods are delivered on board the ship, the risk and liability is transferred from the seller to the buyer (except for FAS). Since the condition of the goods must be checked at this time, these Incoterms apply only to non-containerized cargo.

* In previous versions of Incoterms, the point of transfer of risk between the seller and the buyer is defined in terms of the passage of the goods over the side of the ship.

FAS - Free Alongside Ship Ship Side Delivery (...... Designated Port of Shipment)

The seller takes delivery alongside the buyer's ship at the designated port of shipment. The buyer assumes all costs and risk of loss/damage from the moment of delivery ship-side. FAS requires that the seller is responsible for customs clearance of the exported goods. (In the previous version, the buyer was responsible for arranging export customs clearance).

FOB - Free on Board Delivery on board at port of shipment (...... named port of shipment)

FOB provides that the seller assumes all costs and risks until the goods are loaded on the buyer's designated vessel. The seller's responsibility includes arranging for export customs clearance, while the buyer is responsible for payment of vessel transportation charges, bill of lading charges, insurance, unloading and transportation from the port of arrival to the local area. Any damage to the goods on board the vessel is the responsibility of the buyer.

Since the introduction of the Trade General Rules by the FCA in 1980, FOB should be restricted to non-containerized ocean and inland water shipments. However, FOB remains the most commonly used (including incorrectly used) trade term for all modes of transport, including containerized transport, despite the contractual risks this may entail (e.g. in cases where the goods are in containers that cannot be easily inspected).

CFR - Cost and Freight (...... named port of destination)

CFR puts more risk and liability on the seller, who has to pay for the transportation of the goods until they reach the named port of destination. The risk passes to the buyer when the goods are loaded on board in the exporting country. The shipper pays the cost of export customs clearance and freight charges for transporting the goods to the named port of destination and is responsible for any damage to the goods on board until they reach the port of final destination.

The buyer pays for local transportation from the port to the final destination and is responsible for purchasing insurance. If the buyer requires the seller to purchase insurance, then the trade term CIF should be considered.

Incoterms 2020 states that CFR can only be used for non-containerized ocean and inland water transportation; for other modes of transportation and containerized cargo, CPT should be used instead of CFR.

CIF - Cost, Insurance & Freight Cost, Insurance & Freight (...... named port of destination)

The seller shall clear customs for the exported goods for delivery on board the vessel at the port of shipment. The seller is responsible for transportation costs and insurance to the named port of destination and for any damage to the goods on board. According to the Association Cargo Clause C, the seller must have a minimum level of insurance.

At the port of arrival: The seller must hand over three important documents, namely the invoice, the insurance policy and the bill of lading, which represent the CIF charges, insurance and freight respectively. This trade term is similar to CFR, except that the seller needs to purchase insurance for the goods in transit.

For more details about FAS/FOB/CFR/CIF Incoterms: https://stusupplychain.com/fas-fob-cfr-cif-incoterms.html

For more details about EXW/FCA/CPT/CIP/DPU/DAP/DDP Incoterms: https://stusupplychain.com/exw-fca-cpt-cip-dpu-dap-ddp-incoterms.html