NEWS & BLOG

Views: 76 Author: Site Editor Publish Time: 2022-08-19 Origin: Site

Walmart's Q2 earnings revenue exceeded market expectations, but the inventory problem needs to be solved urgently.

As one of the largest e-commerce platforms in the United States, Walmart has always been regarded as a strong competitor to Amazon. In the case of Amazon's better second-quarter performance, the industry's attention to Wal-Mart has further increased.

Walmart Q2 2023 earnings revenue was $152.9 billion, up 8.4% year-on-year; net profit was $5.147 billion, up 17.9% year-on-year; net profit attributable to listed companies was $5.149 billion, up 20.4% year-on-year. Among them, Sam's Club's same-store sales increased by 9.5% year-on-year, slightly lower than the expected 10.1%, and the number of members reached a record high.

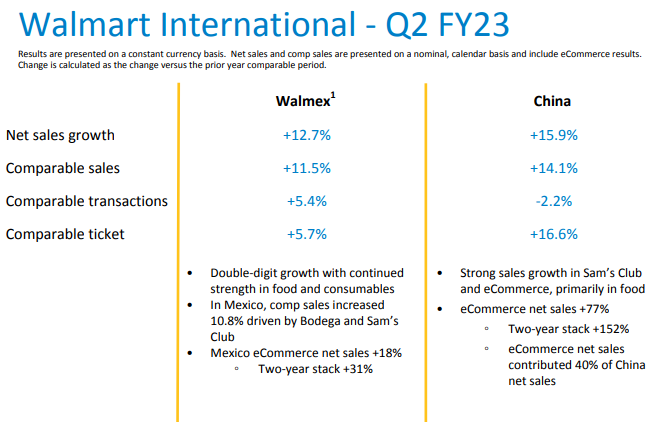

Walmart International net sales were $24.4 billion, up $1.3 billion, or 5.7%, negatively impacted by currency fluctuations of $1 billion. Walmart U.S. sales rose 6.5% and 11.7% for two straight years in the second quarter, continuing to gain market share in the grocery segment.

The market had expected Wal-Mart's second-quarter revenue to be $150.99 billion, which is expected to increase by 7.1% year-on-year. Walmart outperformed market expectations.

In late July, though, Walmart lowered its full-year forecast, saying lower-income consumers were spending more on food, leading them to spend less on lower-margin general merchandise. As a result, the company has had to implement more price cuts to eliminate excess inventory, especially apparel inventory, which will hurt the company's profit margins.

It is worth noting that Walmart China performed well, achieving a 15.9% increase in Q2 net sales and a 14.1% increase in comparable sales. Among them, the Sam's Club and e-commerce business performed well. Wal-Mart China's e-commerce net sales increased by 77%, and the two-year combined growth rate was 152%.

Among them, the revenue of Walmart USA has increased by 6.5% and 11.7% respectively in the past two years. The US e-commerce business has grown by 12% and 18% respectively in the past two years. In the second quarter, Walmart’s net sales in China increased by 15.9%, and its e-commerce net sales increased by 77%. The combined growth rate for the two years was 152%. Its global advertising business grew nearly 30%. Consolidated operating income was $6.9 billion, down 6.8% year over year.

Regarding the expectations for the second half of this year and the whole year, Walmart said that they still maintain the sales forecast of Walmart’s US sales growth of about 3% in the second half of the year and a sales growth of about 4% for the whole year, and revenue will decline. However, due to higher inventory, procurement and other costs and reduced revenue growth, Walmart's cash flow in the first half of the year fell by $5.7 billion compared with the same period last year.

Although the results exceeded market expectations, its ongoing inventory problems are still a major threat.

It is understood that Walmart reiterated its guidance for the second half of the year. The company expects U.S. same-store sales, excluding fuel, to grow about 3% in the second half of the year and about 4% for the full year; full-year adjusted EPS is expected to decline 9%-11%, which is better than previously The expected decline is 11%-13%.

As the nation's largest grocer, Walmart is often seen as a bellwether for the broader economy. Grocery revenue was $56.76 billion in the first quarter ended April 30, or 58.6% of total revenue of $96.99 billion. To put that into perspective, the figure surpassed the grocery chain KR's total first-quarter revenue of $44.06 billion and more than double TGT's total first-quarter revenue of $25.17 billion.

Part of Walmart's sales growth this quarter came from inflation: The latter pushes up the prices of food and other goods. As inflation continues to rise, more customers are turning to its stores, known for their low prices, to fill up their pantries and refrigerators, the company said.

Walmart's reputation as a discount retailer is also attracting more middle- and upper-income shoppers, said Walmart Chief Financial Officer John David Rainey. About three-quarters of the company's food market share growth came from customers with household incomes of $100,000 or more.

On August 3, 2022, the latest Fortune Global 500 list was released simultaneously with the world. Walmart topped the Fortune 500 list for the ninth consecutive year with an operating income of $572.754 billion and a profit of $13.673 billion.

Walmart CEO Doug McMillon said it's great to see more consumers choosing Walmart during this time of intense inflation. Earnings data from Walmart showed that while a recession is still likely in the coming months, consumer spending remains strong.

At present, the United States is in the back-to-school shopping season. Walmart pointed out that the performance of consumers in the back-to-school season is also very strong, which may be affected by the continued rise in employment rates and wage levels, which will be important for the development of the U.S. retail industry in the next few months. Also a good signal.

According to the National Retail Federation, all back-to-school spending in the United States during the back-to-school shopping season may reach $110.8 billion, a record high. Among them, categories such as school supplies, clothing and accessories, shoes, and electronic products are the hottest products among back-to-school shopping consumers.

In terms of shopping methods, the shopping channels chosen by back-to-school consumers mainly include online shopping, department stores, discount stores and so on. Among them, the proportion of households who choose to shop online is the highest, reaching 50%, followed by department stores and discount stores.

But due to ongoing inflation problems in the U.S., price and product value are emerging as key drivers of consumer purchasing decisions. Major U.S. retailers are gearing up to compete for back-to-school consumers.

Most of these retailers choose to start with product price, and Walmart is no exception. Ana Arguello, its vice president of stationery, said: 'We've been working hard to provide consumers with popular back-to-school products at the low prices they expect.

For cross-border sellers, the back-to-school season is also a great opportunity to boost product sales. In the current economic environment in the United States, sellers should pay more attention to the shopping needs of American consumers, provide them with more high-quality and cost-effective products, and win the tough battle of the back-to-school season.