NEWS & BLOG

Views: 43 Author: Site Editor Publish Time: 2022-11-18 Origin: Site

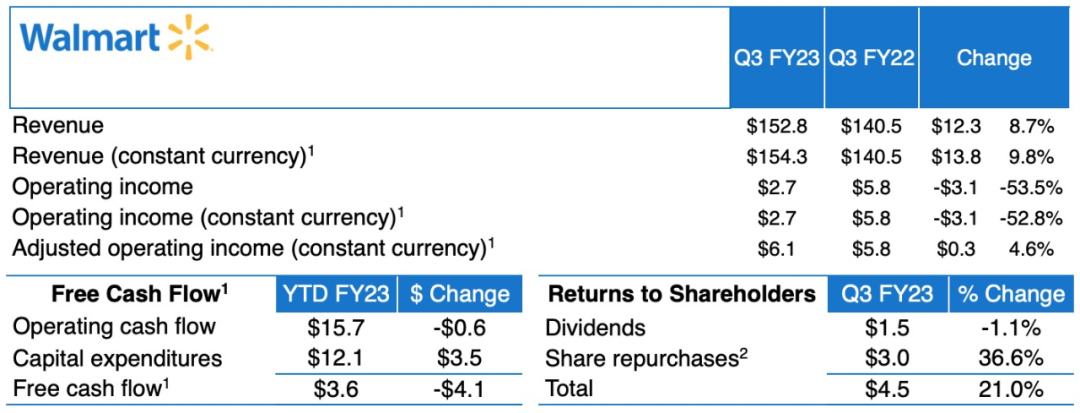

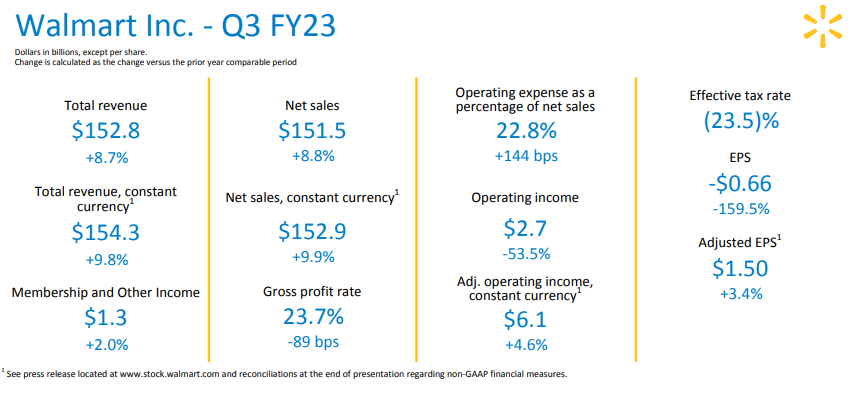

Walmart (WMT.US) reported its FY2023 Q3 earnings results on Nov. 15, EST. According to the earnings information, Walmart reported total revenue of $152.8 billion for the FY2023 Q3, achieving strong revenue growth of 8.7% (9.8% at constant currency) with strong performance across market segments.

According to the earnings report, Walmart U.S. comparable sales increased 8.2 percent year-over-year in FY2023 Q3, with e-commerce up 16 percent and cumulative growth of 24 percent over two years. Walmart Sam's Club comparable sales increased 10.0 percent, while membership revenue increased 8.0 percent and membership reached a record high. In addition, Walmart Grocery continued to grow its market share. According to information in the company's fiscal year 2022 annual report, Walmart has e-commerce site operations in the United States, Africa, Canada, Central America, Chile, China, India and Mexico.

For international operations, Walmart International reported net sales of $25.3 billion, an increase of $1.7 billion, or 7.1% (before excluding the impact of currency fluctuations), led by double-digit revenue growth at Walmex. Walmex is said to operate in six countries: Costa Rica, El Salvador, Guatemala, Honduras, Mexico and Nicaragua. According to the company's FY2022 annual report information, Mexico and Central America are Walmex's highest net sales markets overseas, followed by Canada and China.

In the advertising business, Walmart's global advertising business, on the other hand, grew more than 30%, with Walmart Connect in the U.S. growing 40%. Advertising growth at Flipkart (one of India's largest e-commerce companies), which Walmart acquired a majority stake in in 2018, was equally strong.

In terms of gross margin, Walmart's consolidated gross margin declined 0.89% in the quarter, primarily due to price reductions and sales mix in the U.S., inflation-related LIFO charges at Sam's Club, and the timing of Flipkart's annual event, The Big Billion Days, being impacted by the epidemic.

On the revenue side, consolidated operating expenses as a percentage of net sales increased by 1.44% due to $3.3 billion in charges related to the opioid legal settlement. Adjusted operating expenses as a percentage of net sales decreased 0.75 percent, primarily due to strong sales growth and lower costs associated with the epidemic. Consolidated operating income for the quarter decreased 53.5 percent to $2.7 billion, including the legal fees noted above. Adjusted consolidated operating income was $6.0 billion, an increase of 3.9 percent.

Adjusted earnings per share were $1.50, excluding the impact of a $1.11 net loss on equity and other investments and a $1.05 charge related to the opioid legal settlement. Subsequent to the third quarter, Walmart approved a new $20 billion share repurchase authorization to replace the existing authorization, which had approximately $1.9 billion remaining at the end of the third quarter.

For Q4, Walmart said in its earnings release that consolidated net sales for the fourth quarter will increase approximately 3.0 percent, with Walmart U.S. consolidated sales (excluding fuel) of approximately 3 percent, negatively impacted by currency fluctuations of approximately $1.3 billion; consolidated operating growth of 1.0 percent year-over-year to a decline of 1.0 percent; and adjusted earnings per share declines of 3 percent to 5 percent.

For fiscal year 2022, Walmart's consolidated net sales increased 5.5 percent, above the 5.06 percent growth generally expected. Walmart's U.S. consolidated sales (excluding fuel) increased approximately 5.5 percent; consolidated adjusted operating income declined 6.5 percent to 7.5 percent, an improvement over the company's previous declining guidance.

We had a well-performing quarter with strong global revenue growth led by Walmart, Sam's Club U.S. and Flipkart," said Doug McMillon, president and chief executive officer of Walmart. Walmart U.S. was able to continue to gain market share in the grocery market, helped by growth in the food business unit. We significantly improved our inventory position in the third quarter and will continue to make progress through the end of the year."

Walmart FY2023 Q3 Performance:

· Revenues of $152.81 billion, up 8.7 percent year-over-year, compared to expectations of $147.75 billion.

· Net sales up 8.8% year-over-year to $151.47 billion.

· Operating profit down 53.5 percent year-over-year to $2.7 billion.

· A net loss of $1.77 billion, compared to a net profit of $3.13 billion in the prior year period.

· Adjusted earnings per share of $1.50, compared to expectations of $1.32.

In addition to strong grocery sales, Walmart's results in the third quarter were boosted by the U.S. back-to-school season and global sales events, including Flipkart's (the Indian e-commerce giant, owned by Walmart) "The Big Billion Days" promotion, Walmart CEO Doug McMillon said at the earnings meeting. " promotion.

In Q3 2023 Walmart's U.S. e-commerce sales grew 16 percent year-over-year and 24 percent cumulatively over two years. Along with the growth in online market share, Walmart's advertising business also delivered a strong performance. In the third quarter, Walmart's global advertising revenue grew more than 30 percent year-over-year.

John David Rainey, Wal-Mart's chief financial officer, said Americans' wallets are stretched thin due to inflation. They are buying lower-priced proteins, such as hot dogs, beans and peanut butter, instead of higher-priced meats. They are buying lower priced baby products and bakery items, including more Walmart private label products. They are waiting for sales events to buy items such as TVs and air fryers. At the same time, they are spending less on clothing and household items.

Walmart attracted more high-income shoppers in the third quarter. About 75 percent of its food market share growth came from households earning more than $100,000 a year. And this trend was also seen in the previous quarter. In addition, Walmart's overstocking problem eased, with inventory at Walmart increasing 13% year-over-year in the third quarter, down from 26% in the second quarter and 32% in the first quarter.

By segment, Walmart U.S. sales increased 8.2 percent year-over-year in the third quarter and 17.4 percent cumulatively over two years; Sam's Club sales increased 10 percent year-over-year and 23.9 percent over two years; membership revenue increased 8 percent and membership reached an all-time high; and Walmart International net sales were $25.3 billion, up 7.1 percent year-over-year. Walmart's global advertising business grew more than 30 percent, with Walmart Connect in the U.S. up 40 percent and Flipkart Ads also performing strongly.

Walmart is "cautious" about holiday sales due to global economic uncertainty and U.S. inflation near a forty-year high. For the fourth quarter, Walmart expects consolidated net sales growth of approximately 3 percent; Walmart U.S. consolidated sales (excluding fuel) of approximately 3 percent; consolidated revenue growth of 1.0 percent to a decline of 1.0 percent; and adjusted earnings per share declines of 3 percent to 5 percent. For fiscal year 2022, consolidated net sales grew 5.5 percent versus a 5.06 percent increase widely expected. Walmart U.S. consolidated sales (excluding fuel) grew approximately 5.5 percent; consolidated adjusted operating income declined 6.5 percent to 7.5 percent, an improvement over the company's previous declining guidance.