NEWS & BLOG

Views: 442 Author: Site Editor Publish Time: 2022-10-08 Origin: Site

For those of you who are frequent clients in Brazil, you may come across the term tax code a lot. The term "tax code" is short for Value Added Tax NO. That's right, all parcels sent to Brazil, regardless of value and weight, must have the recipient's locally registered tax number stated on the waybill and invoice when filling out the waybill and invoice.

The VAT (Value Added Tax) numbers in Brazil are divided into two types as follows.

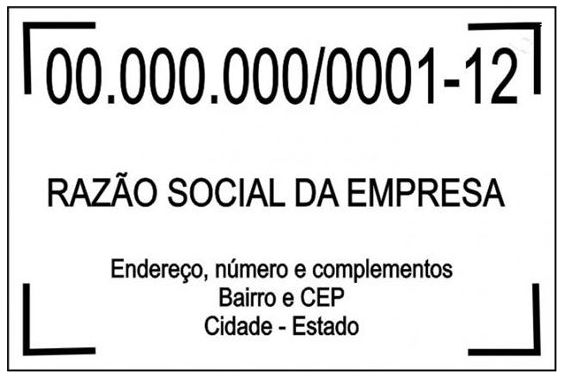

1. CNPJ NO. (Company-XX.XXX.XXX/XXXX-XX)

2. CPF NO. (Private - XXX.XXX.XXX/XX)

CPF - Individual Taxpayer Registry ["Cadastro de Pessoa Física"]

The CPF (Cadastro de Pessoa Física) is a Brazilian document that is required for a number of business and legal procedures. It can be issued to both Brazilians and foreigners. If, for some reason, you need a CPF, here are the procedures on how to obtain one.

Registration in the Individual Taxpayer Registry (CPF) is mandatory for Brazilian or foreign nationals of any age who own or wish to own assets and rights in Brazil that require public registration, including real estate, vehicles, ships, aircraft, equity/stocks, bank accounts or financial/capital market investments.

The CPF number is issued only once (uniquely and definitively) and it is not possible to register twice. The CPF number will be generated at the time of registration and will be recorded on the receipt provided to the applicant. The number must be kept in a safe place or remembered, as no further 'CPF cards' will be issued.

Due to tax privacy regulations, those who have lost/forgotten their CPF number must retrieve it directly from one of the units of the Federal Tax Agency ("Receita Federal") in Brazil, as this issue cannot be resolved at the Consulate. If necessary, the application can be made by a representative of the party concerned. Further clarifications can be obtained by email: cpf.residente.exterior@receita.fazenda.gov.br

CNPJ - Cadastro Nacional da Pessoa Juridica

The CNPJ is theNational Registration Number of Legal Persons (in this case legal persons are companies), which is issued by the Brazilian Ministry of Finance. Every regular shop in Brazil must display a sign similar to the Chinese "business licence", which must have the CNPJ registration number on it. Bus tickets in Brazil must also have the name of the operating company and the CNPJ number on them.

For exports to Brazil, including sending samples, the CNPJ of the client company must be provided, i.e. their tax number. It is usually made up of 14 digits. It is usually entered in the "Recipient's Customs Tax Number" section of the courier note.

The significance of the CNPJ is similar to that of a Chinese citizen's identity card and is the only legal identification of a Brazilian company in Brazil. If you ask the company for their CNPJ and they are unable to provide it or provide a CNPJ that cannot be verified by the Brazilian government authorities, then the company probably does not exist! Then business will have to be conducted with extreme caution!

Therefore, before sending any courier to Brazil, make sure that the tax number of the other party cannot be wrong. If you can't reach the customer in an emergency, if you know the full name of the other company, you can search for "CNPJ company name" in google engines, and you can usually find the tax number of the other party. Of course, the safest way to find out is from the customer.

For example: CPF: 007.408.869-67.

For all parcels sent by courier to Brazil, the recipient's local VAT number must be entered on the waybill (column 9, Special Delivery Instructions) and on the commercial invoice.

The local VAT number is divided into two types: CNPJ (Company - XX.XXX.XXX/XXXX-XX) and CPF (Private - XXX.XXX.XXX/XX). 2.

2. 100% of imported parcels are inspected by Brazilian Customs.

If the VAT number is not indicated on the invoice and waybill when the shipment is sent, the shipment will be automatically returned to the place of dispatch and a return fee will be charged to the place of dispatch.

Note: Parcels sent to Brazil are subject to local customs duties regardless of value and weight.

1. Brazil has adopted a policy of trade protection by imposing duties on goods imported from abroad in order to protect its industrial production.

2. From 1 June 2005, all express consignments and invoices imported to the local area must provide details of the recipient's name, address and declared value in US dollars, otherwise they will be automatically returned to the place of dispatch and the relevant return charges will be charged directly to the sender.

3. At present, express shipments to Brazil are transhipped through Miami, USA and imported by EDI electronic customs declaration. The amount of customs duty is known when the parcel type goods are transhipped through Miami, and the service provider will contact the recipient company to confirm the payment of customs duty.

4. As of 31 August 2005, all invoices and waybills for items imported into Brazil must include the recipient's relevant tax ID number in order to collect the relevant duties. Items declared without the recipient's tax ID will be held by customs for 30 days, after which they will be automatically returned to the place of dispatch and the relevant charges will be charged directly to the dispatching company.

5. Notice of non-acceptance of used items in Brazil.

DHL Hong Kong has notified that Brazil Customs will not accept used items for import to local consignee companies, except for personal items. In the case of personal effects, the consignee must be an individual and declare the name of the goods in detail on the invoice and clearly state that it is a personal item, otherwise the shipment will be automatically returned to the local authorities without prior notice to the consignor and all costs incurred will be borne by the consignor.

6. Only original bills of lading will be accepted for customs clearance in Brazil and all Brazilian ports will stop accepting private goods from April 2018, even if the consignee is able to clear customs on his own and has the right of entry.