NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-12-24 Origin: Site

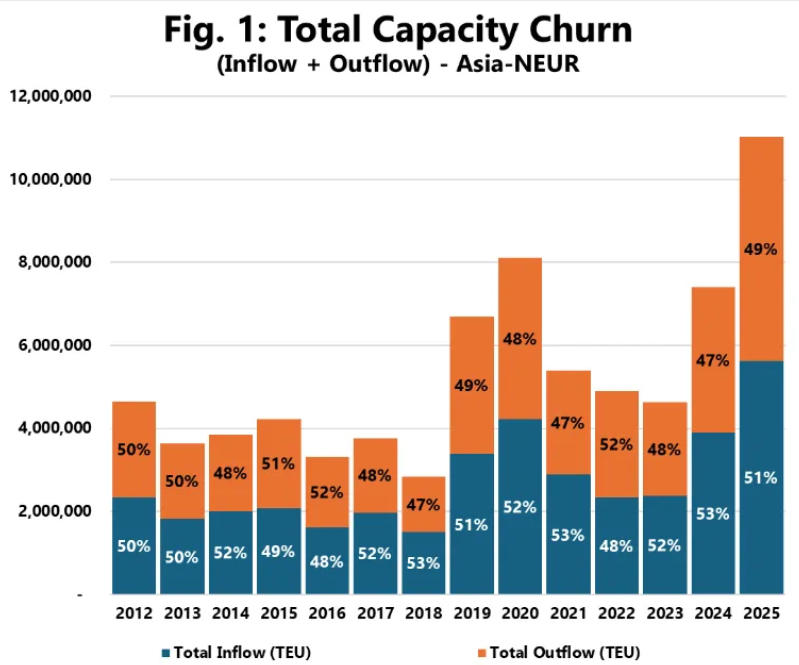

In 2024, the operational stability of Asia-Northern Europe, North America, and Mediterranean routes has completely disappeared, with capacity fluctuations reaching an unprecedented level. A structural reshaping of the global shipping market is underway, as carriers shift from stable vessel scheduling to frequent and high-intensity capacity adjustments—trends further amplified by major players like Mediterranean Shipping Company (MSC) reshuffling their ultra-large container ship deployments.

Sea-Intelligence, a leading provider of global supply chain research, analysis, data services, and consulting, analyzed the operational stability of Asia-North America and Asia-Europe trade routes using "operational capacity fluctuation" (total capacity entering and exiting a trade route, an indicator to measure fluctuation levels and carrier capacity deployment changes) in its latest industry report.

Asia-North America West Coast: Capacity fluctuation hit a record 10.4 million TEU, a 32% increase from 2024.

Asia-Mediterranean: Fluctuation reached 6.9 million TEU, up 80% from 2023 and 21% from 2024. Notably, MSC redirected its withdrawn ultra-large ships to this route, boosting the average capacity of its "Jade" West Mediterranean route to 23,550 TEU <superscript>1.

Asia-North America East Coast: Fluctuation remained high at 6.6 million TEU but grew steadily compared to other routes.

The predictable "cascade buffer" effect—where capacity smoothly flows from major trade routes to secondary ones—has been replaced by a highly dynamic system. Today, vessels are frequently rerouted, with a clear trend of capacity previously absorbed by major Asia-Europe routes shifting to secondary trade routes.

MSC’s capacity restructuring exemplifies this shift. Amid plummeting Asia-Northern Europe freight rates (down 44% year-to-date to $1,578/TEU by February 2025), the carrier redirected its 24,000 TEU-class ships to high-margin routes like Asia-Mediterranean (freight rate $2,624/TEU) and Asia-West Africa (freight rate $4,000/TEU) .

It even deployed ultra-large ships on its Africa Express route for the first time, leveraging upgraded West African ports’ ability to handle megamax vessels.