NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-04-15 Origin: Site

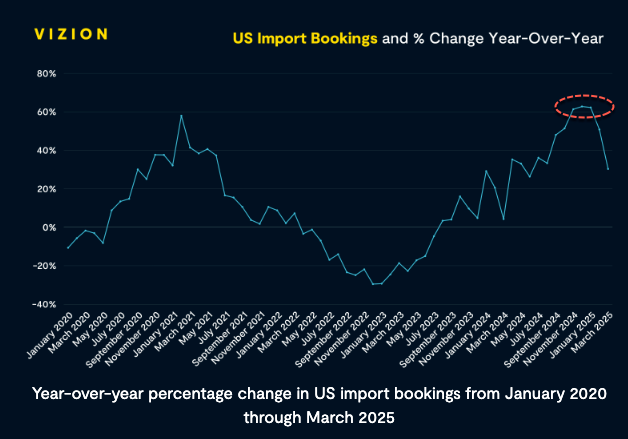

The U.S. maritime trade faces abrupt disruption due to a "tariff storm" initiated by the Trump administration. According to freight data firm Vizion, import orders—after a Q1 surge—are now collapsing. Data comparing late March to early April 2025 reveals a 49% drop in container bookings and a 64% decline in total U.S. imports, attributed to shippers halting shipments amid policy uncertainty.

President Trump’s tariff policies have thrown U.S. shipping into turmoil. Vizion’s report, "Tariff Shockwaves," tracks a dramatic reversal: After peaking in early 2025, bookings fell 20% from January to March, though still 30% higher year-over-year—likely due to pre-tariff frontloading. By April, real-time bookings crashed, coinciding with U.S.-China tariff announcements.

Key Findings:

Weekly collapse (March 31–April 6 vs. prior week):

Apparel/accessories: -59%

Textiles/fabrics: -57%

Discretionary goods (art, gems, etc.): -50%+

Chinese industrial imports hit hardest: Plastics, copper, and wood products—integral to manufacturing—face severe tariff pressure.

U.S. farmers fear an export crisis. The CNN reports (via Global Times) warn that the U.S.-China tariff war could "devastate American farmers first." The Soybean Association chairman cautioned that prolonged tensions may trigger widespread bankruptcies.

Vizion analysts note shippers’ "accelerate-then-freeze" behavior—rushing orders pre-tariff, then pausing mid-transit to reassess costs. With other U.S. trade partners’ tariffs in a 90-day freeze, 2025 may see continued volatility: demand shocks, erratic orders, and global supply chain recalibrations.