NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-11-25 Origin: Site

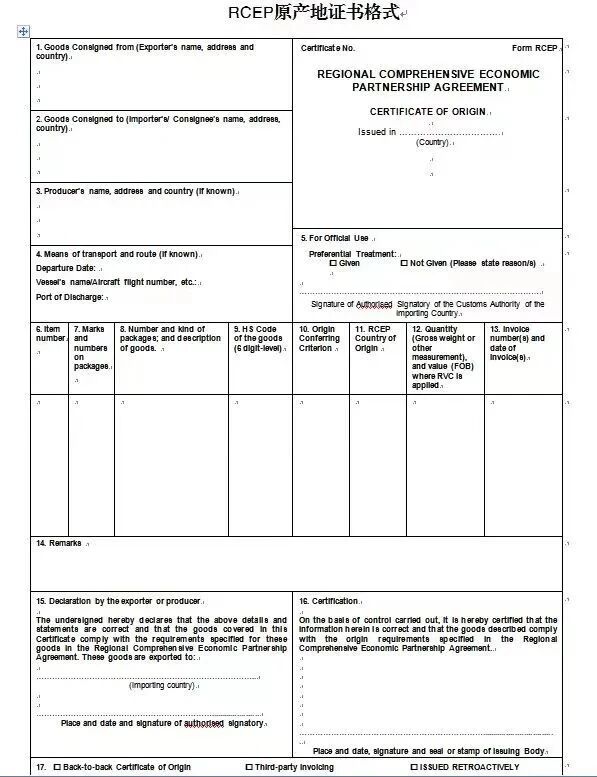

The format of the COO uploaded during declaration must comply with official requirements. It should be a color scanned copy of the original document with clear content. Upload the "ORIGINAL" copy—do not submit "COPY" or "TRIPLICATE" copies.

The signature and seal in the "Issuing Authority" and "Exporter" sections of the COO must be complete and legible.

The exporter name on the COO must be consistent with that on the invoice and contract.

Special attention to date requirements:

(1) Issuance date rules:

Asia-Pacific Trade Agreement (APTA): Within 3 working days of export or shipment.

China-ASEAN FTA: Before or at the time of shipment; within 3 days after shipment in case of force majeure.

China-Peru FTA & China-Australia FTA: Before or at the time of export.

Regional Comprehensive Economic Partnership (RCEP): Before shipment.

(2) Validity period: 1 year from the date of issuance for APTA, China-ASEAN FTA, China-Peru FTA, China-Australia FTA, and RCEP.

(3) Retroactive issuance period:

China-ASEAN FTA: Within 12 months.

China-Australia FTA: Within 1 year from shipment.

APTA: No retroactive issuance allowed.

If the COO is not issued within the specified time and the issuing authority issues a retroactive certificate, the phrase "ISSUED RETROACTIVELY" must be clearly indicated on the document.

The vessel name and voyage number on the COO must match those declared on the customs declaration form.

HS code consistency requirements:

APTA: First 4 digits of the HS code must match the customs declaration.

Cross-Strait Economic Cooperation Framework Agreement (ECFA): First 8 digits of the HS code must match.

Other preferential trade agreements: First 6 digits of the HS code must match.

The quantity and unit of measurement on the COO must be consistent with the customs declaration. For example, under the China-ASEAN FTA, if the COO lists quantity as "Gross weight or net weight or other quantity" without special clarification, it defaults to gross weight—this must match the gross weight on the customs declaration. Any quantity exceeding the COO’s stated amount is ineligible for preferential tariff rates.

The "Origin Mark" entered by the enterprise in the Single Window must align with the "Origin criterion" or "Origin Conferring Criterion" on the COO—ensure accurate entry during declaration.

The invoice number and date on the COO must match those of the invoice attached to the customs declaration.

Box 13 of the China-ASEAN FTA COO covers four scenarios: intra-member circulation, retroactive issuance, triangular trade, and exhibition goods. Check the relevant items correctly if any of these apply.

Incorrect COO format: Ineligible for preferential tariffs. For non-original color scans or unclear content—if the original COO meets requirements—submit a modification application via the Single Window, upload the compliant COO, and retain the original for inspection.

Incomplete or illegible signature/seal: Submit a modification application via the Single Window to upload a compliant COO. For illegible signatures/seals—if the original is valid—retain the original for inspection.

Mismatched vessel name/voyage number: Verify compliance with the direct transport principle. Provide full transport documents as required by the applicable preferential trade agreement. For goods involving transshipment, compliance with direct transport rules is determined based on documents specified in General Administration of Customs Announcements 2015 No. 57 and 2016 No. 52. If the mismatch is due to the shipping company, attach an explanation.

Mismatched invoice number/date: For inconsistencies caused by triangular trade, etc., upload relevant commercial documents proving the trade relationship and an explanation.

Mismatched exporter name: Provide the manufacturer’s invoice.

Declared price lower than FOB price on COO: Provide documents proving price authenticity (e.g., foreign exchange payment tax forms, commercial correspondence) and an explanation.

COO issued outside the specified time without "ISSUED RETROACTIVELY" notation: Contact the issuing authority to amend the certificate.