NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-07-11 Origin: Site

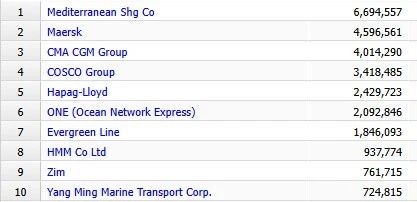

MSC – 6.6M TEU (+5.5%)

Unstoppable growth: Added 365K TEU (31% of global increase).

Dual strategy: 25 new ships (316K TEU delivered) + aggressive secondhand purchases.

Future-proof: 2M+ TEU orderbook, including 12 Neo-Panamax vessels (15,400–16,200 TEU).

Maersk – Holds 2nd place but slows expansion, pivoting to integrated logistics.

CMA CGM – Strong orderbook trails MSC; steady mid-year performance.

COSCO Shipping – Focused on newbuilds; expands Asia-Europe routes.

Hapag-Lloyd – Post-merger efficiencies boost profitability despite moderate growth.

ONE – Fastest grower (+5.9%):

6 new 14K TEU ships deployed.

Shifts from leasing to owned fleet; 650K TEU orderbook.

Evergreen – Growth plateaus post-delivery surge but improves network efficiency.

HMM – 5.1% growth (above industry avg.), backed by South Korean government.

ZIM – Only decliner (-2.4%): Light-asset adjustment delays new ships to 2026.

Yang Ming – 2.7% growth (lowest among top 10); leased-heavy fleet risks losing spot to Wan Hai (#11).

MSC’s Snowball Effect: 5-year expansion streak; new + secondhand ships fuel dominance.

ONE’s Rise: Japanese-Singaporean synergy drives shift from leasing to owned capacity.

⚠️ Ranking Alert: Wan Hai (#11, 368K TEU orderbook) could replace Yang Ming soon!