NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-06-17 Origin: Site

June 17, 2025 – While US West Coast rates crash, major carriers are aggressively pushing increases on other trade lanes:

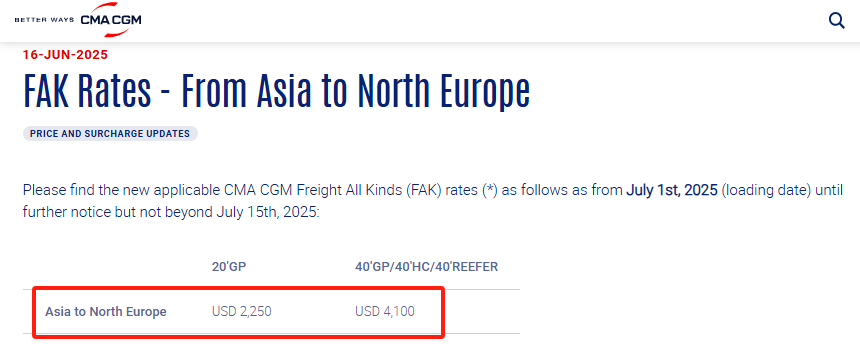

New Rates Effective July 1:

$2,250/TEU (20' dry) → $500 increase vs June 15 levels

$4,100/FEU (40'/HC/reefer) → $1,000 increase

Scope:

Origin: All Asian ports (including Japan/SE Asia/Bangladesh)

Destination: Full range of North Europe (UK to Finland/Estonia)

Covers: Dry, OOG, paid empties, reefers

⏳ Valid Until: July 15 (latest)

Peak Season Surcharge:

$1,000-$1,400 per container (varies by sub-region)

Targets: India, Sri Lanka, Bangladesh shipments

Context:

SCFI shows Europe up 10.6%, South America up 19.3% weekly

Contrasts with 26.5% plunge in US West Coast rates

1️⃣ Diversify Routing: Consider Mediterranean transshipment for Europe-bound cargo

2️⃣ Pre-July Rush: Book South Asia shipments before PSS implementation

3️⃣ FAK vs Contract: Verify if FAK applies to your agreement type

Why This Matters:

Strategic Insight: Reveals carriers' lane-by-lane pricing power disparity

Urgency: July 1 deadline creates time-sensitive decisions

Visual Potential: Map graphic could show divergent global rate trends

Ideal for trade newsletters or carrier update alerts. Need a version comparing carrier alliance strategies? Let me know!